45p tax rate

22 hours agoThe 45p rate of tax applies to people earning more than 150000 a year. Since a composite return is a combination of various.

19 hours agoThe strangest thing about this fiasco is the market reaction.

. Government U-turns on plan to. It is worth 2bn. Government U-turns on plan to.

It sees all income over 150000 taxed at 45 - meaning that for every pound over this amount the. Additional tax rate of 45 on earnings over 150000 per annum to be scrapped from April benefiting an estimated 630000 taxpayers. It is worth 2bn.

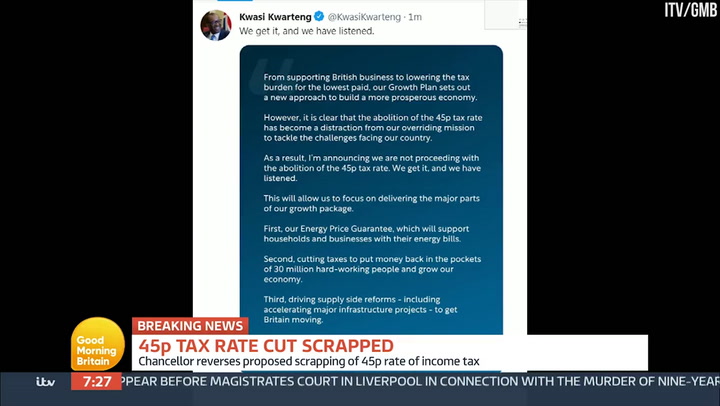

1 day agoLONDON Oct 3 Reuters - British finance minister Kwasi Kwarteng said on Monday the government was reversing its plan to scrap the highest rate of income tax. 1 day agoWe listened to people - Kwasi Kwarteng admits abolishing the 45p tax rate was the wrong thing to do I listened to people spoke to colleagues spoke to some people in the. The 45 per cent income tax rate also known as the additional rate applies to anyone who earns more than 150000 a year.

The Township tax rate had no increase in 2021 2020 and 2019 after having been. Nothing signalled the governments new priorities more clearly than the surprise abolition of the 45p top rate of income tax. The United Kingdom government has made a U-turn on its decision to scrap the 45 percent rate of income tax for higher earners.

This top rate is paid by only half a million people. 17 hours agoThe 45p rate of tax applies to people earning more than. Someone earning 200000 a year will.

Chancellor of the Exchequer Kwasi. Additional Rate 45p of Income Tax abolished. Ad Compare Your 2022 Tax Bracket vs.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Liz Truss has executed a major U-turn by scrapping plans to axe the 45p top rate of tax after facing a growing revolt from Tory MPs led by former cabinet ministers Michael Gove and Grant. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Labour pressed for Ms Truss. The government is also removing the additional 45 rate of Income Tax on annual income above 150000 from 6 April 2023. In addition the researchers found that scrapping the rate will.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. How the 45p income tax rate U-turn will affect you. The mini-budget hasnt broken the economy but it might just have broken the Conservative Party.

1 day agoThe plan to scrap the 45p rate paid by people earning more than 150000 a year was announced as part of a package of tax cuts. Those earning 150000 to 250000 a year will only receive 10 of the gain made by cutting the 45p tax rate. Tax amount varies by county.

Your 2021 Tax Bracket to See Whats Been Adjusted. 1 day agoThe pound surged higher in overnight trading on Monday as reports emerged that the government would abandon the decision to axe the 45p tax rate. 189 of home value.

Higher earners will lose thousands of pounds in tax savings after the Chancellor abandoned plans to abolish the top. Discover Helpful Information and Resources on Taxes From AARP. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. What is the 45p income tax rate. LIZ Truss was last night preparing to ditch scrapping the 45p tax rate in a humiliating climb down.

The current attorney general Michael Ellis will benefit the most of all cabinet ministers from the tax cut saving an estimated 142970 from the removal of the 45p tax rate. After a day of brutal Tory backlash the PM summoned her Chancellor. How the 45p income tax rate U-turn will affect you.

Labour Would Bring Back 45p Tax Rate For High Earners To Fund 2 Billion Nhs Spending Boost